To know more about the scheme, checkout the video of equity fund manager.

To know more about the scheme, checkout the video of equity fund manager.

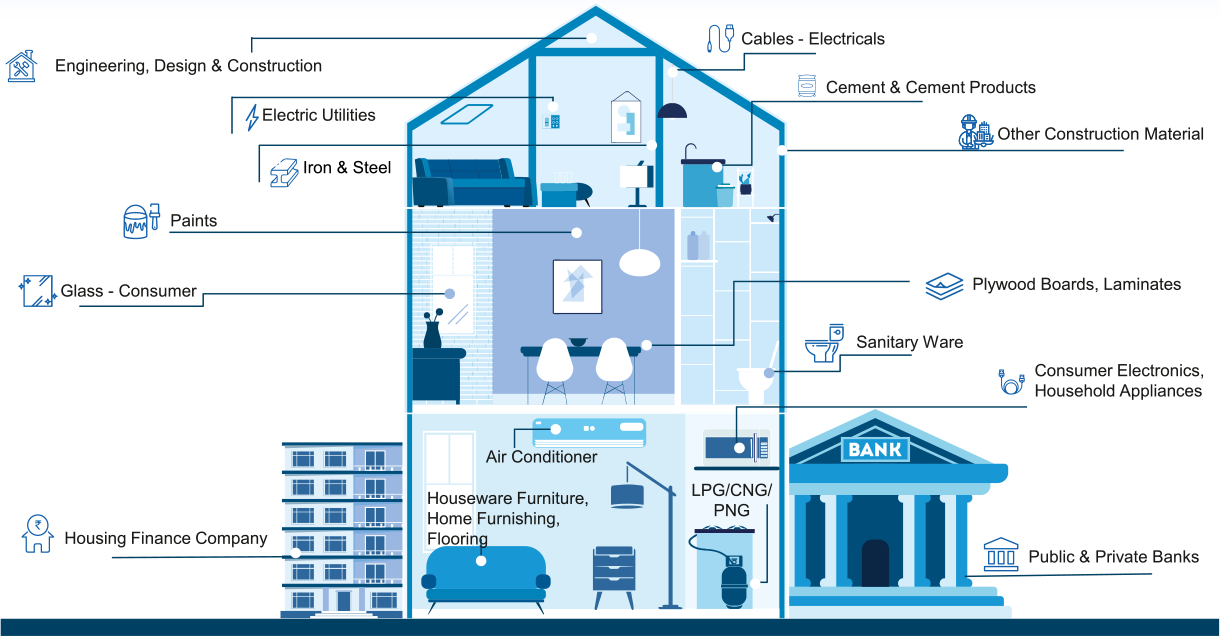

The current market correction offers a good entry point for most of these businesses. Lower exposure to defensive sectors offers a better way to play economic recovery (based on current views & may subject to change)

The list of industries are indicative and not exhaustive. Fund Manager will follow AMFI/NSE classification from time to time.

| Scheme Name | TATA HOUSING OPPORTUNITIES FUND |

| NFO Date | NFO Opens: 16th August 2022 NFO Closes: 29th August 2022 |

| Investment Objective | To generate long - term capital appreciation by investing predominantly in equity and equity related instruments of entities engaged in and / or expected to benefit from the growth in housing theme.However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns |

| Type Of Scheme | An open - ended equity scheme following housing theme. |

| Fund Manager | Tejas Gutka, Venkat Samala and Murthy Nagarajan |

| Benchmark | NIFTY Housing Index (TRI) |

| Min. Investment Amount | 5,000/- and in multiples of 1/- thereafter |

| Load Structure | Entry Load: N.A. Exit Load:

|

Debt Portfolio

MURTHY NAGARJAN

Head - Fixed Income

Equity Portfolio

tejas gutka

Fund Manager

Overseas Investment

venkat samala

Fund Manager & Analyst

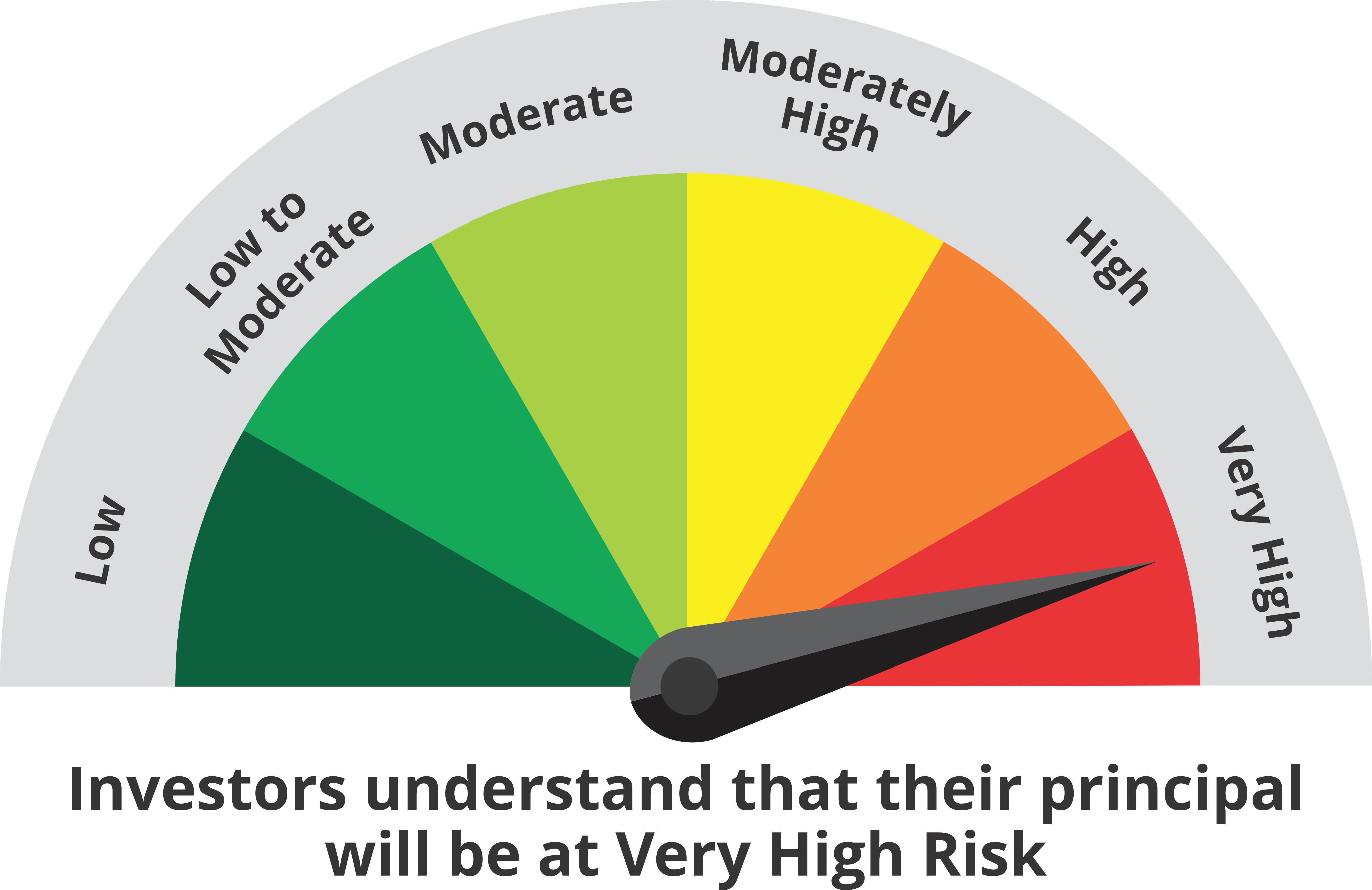

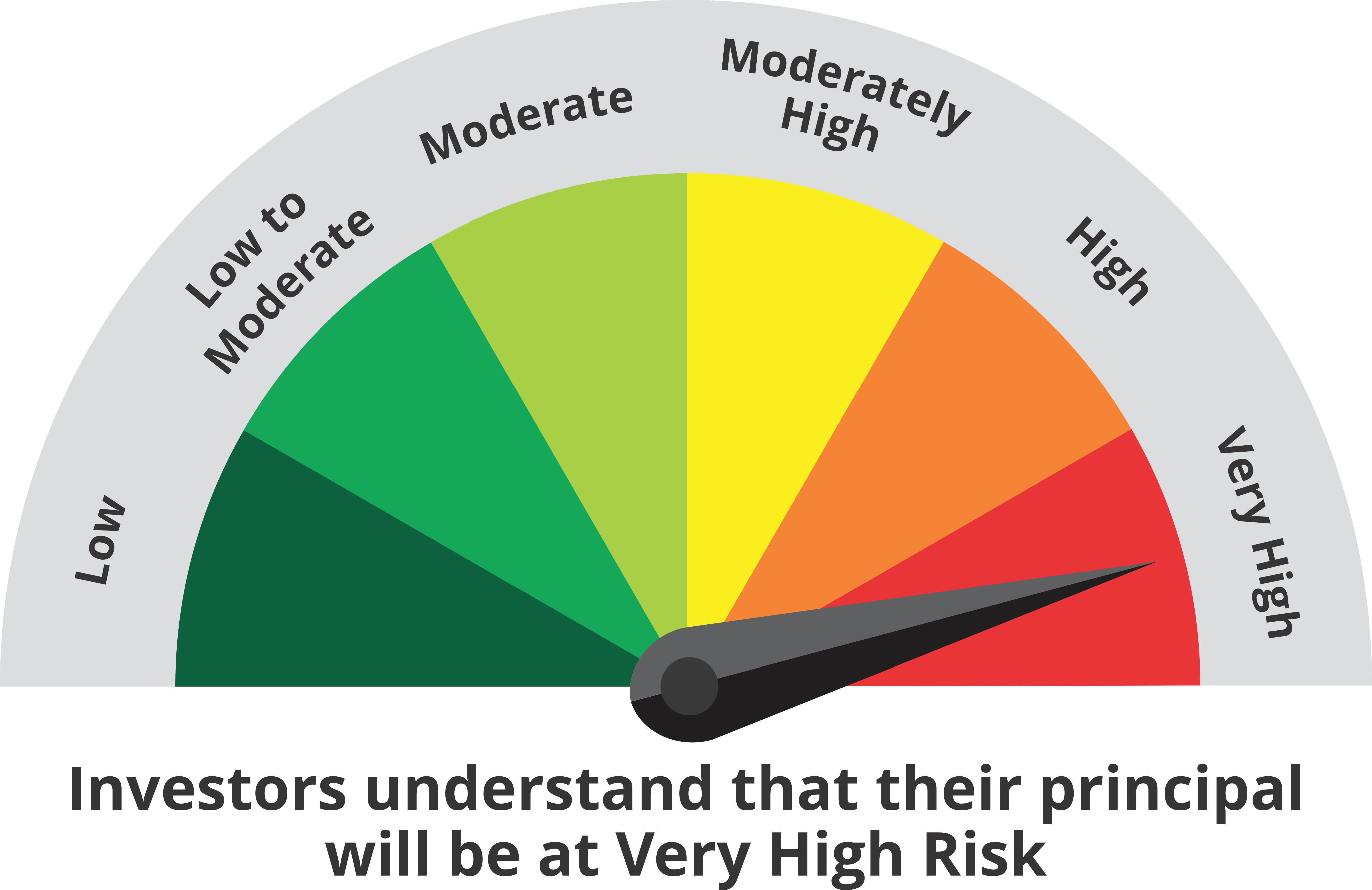

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051